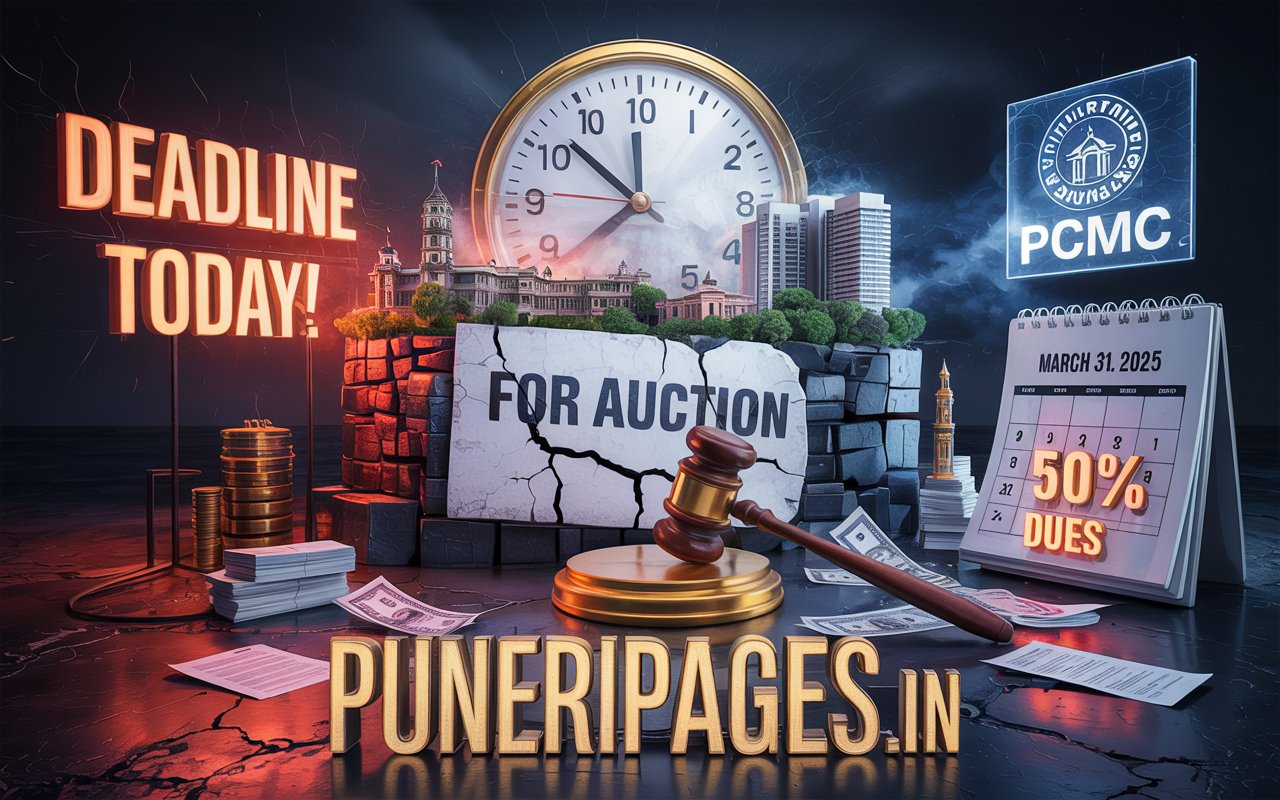

⏰ Deadline Alert: 467 Properties to Be Auctioned Today

The Pimpri Chinchwad Municipal Corporation (PCMC) has issued a final warning to property tax defaulters: today, March 31, 2025, is the last day to save your properties from auction!

- 490 non-residential, industrial, and mixed-use properties were initially listed for auction.

- 36 defaulters have paid over ₹1 crore in partial dues, reducing the auction list to 467 properties 1.

- To avoid auction, owners must clear at least 50% of dues if outstanding taxes exceed ₹2 lakh 1.

Urgent Notice: If no bidders emerge, PCMC will acquire properties for ₹1 under the Maharashtra Municipal Corporations Act 1.

💸 Key Financial Figures

- ₹15 crore in pending dues from 467 properties.

- ₹11 crore already recovered from 567 defaulters since December 2024 1.

- Additional penalties: Defaulters who miss the deadline will face 15% auction expenses added to their dues 25.

📝 How to Avoid Auction

- Pay Online Immediately:

- Visit the PCMC portal, navigate to Residents > Property Tax > Pay Property Bill Online, and enter zone number, Gat number, and property code 10.

- Use UPI, debit/credit cards, or net banking for instant payment.

- Offline Payment:

- Visit PCMC’s Property Tax Department offices in Nigdi, Akurdi, Chinchwad, or other zones (full list here) 6.

- Partial Payment:

- Pay 50% of dues if outstanding taxes exceed ₹2 lakh to remove your property from the auction list 1.

⚠️ Consequences of Missing the Deadline

- Permanent Loss: Properties will be auctioned publicly, with ownership transferred to the highest bidder.

- Financial Burden: Defaulters will bear 15% auction costs and lose future rights to reclaim assets 25.

- Legal Action: PCMC may escalate recovery measures, including home visits for residential defaulters 1.

🗣️ Official Statements

- Shekhar Singh, PCMC Municipal Commissioner:

“Our goal is to become a ‘Tax Dues-Free Municipal Corporation.’ We urge defaulters to act now to avoid irreversible consequences.” 1. - Avinash Shinde, Assistant Commissioner:

“The next phase will target residential defaulters. Pay 100% dues today to avoid inconvenience.” 1.

📅 Timeline of PCMC’s Recovery Drive

- December 2024: Seizure of 1,057 properties begins.

- March 2025: Deadline extensions granted, but only partial payments accepted.

- Today: Final auction unless 50% dues are paid 15.

🔍 What’s Next?

- Post-Auction: Unsold properties will be acquired by PCMC for ₹1 1.

- Residential Defaulters: PCMC plans to visit homes of residential tax evaders starting April 2025 1.

📞 Need Help? Contact PCMC

- Phone: 020-67333333 / 020-28333333 (extension 1506) 69.

- Email: egov@pcmcindia.gov.in 10.

- Office Address: Ground floor, PCMC Main Building, Mumbai-Pune Road, Pimpri 6.

💡 Pro Tips for Property Owners

- Check Rebates: Timely payments qualify for 5–10% discounts 10.

- Avoid Penalties: Delayed payments incur 2% monthly fines (up to 24% annually) 10.

- Stay Updated: Follow PCMC’s official portal for future notices.

🛑 Don’t Wait!

With hours left, defaulters must act swiftly to secure their assets. Share this alert to help others avoid losing their properties!

For official guidelines and payment links, visit PCMC’s website.