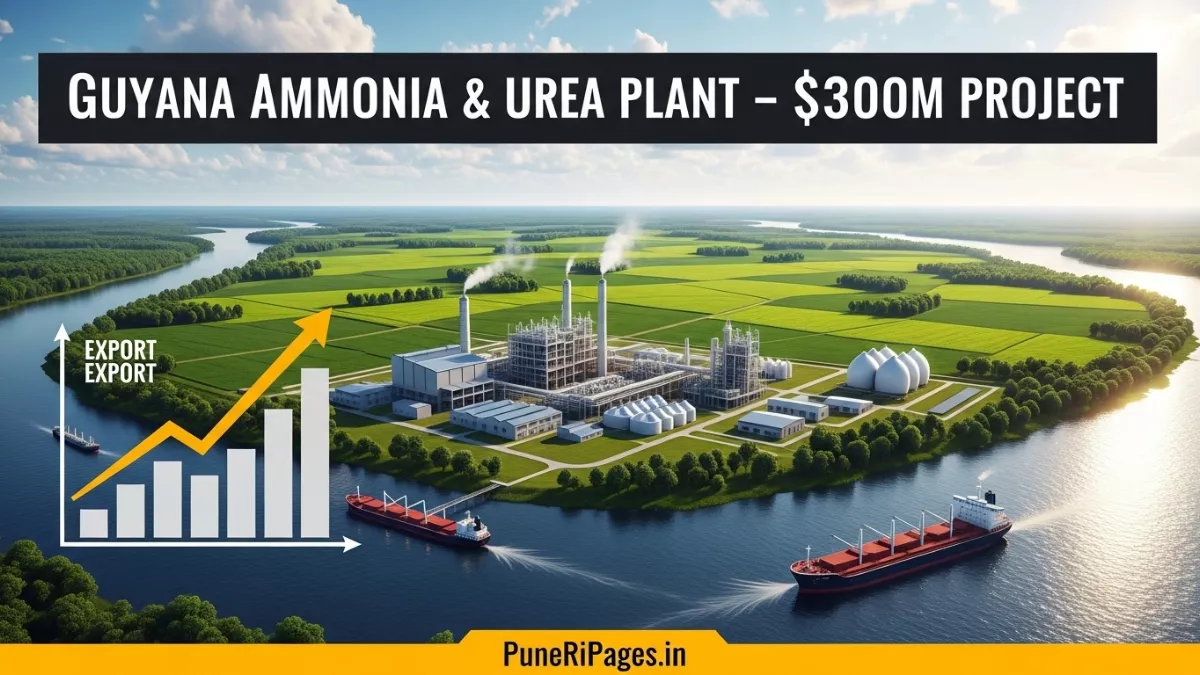

US$300M Guyana ammonia and urea plant project to support agriculture and regional trade.

By Prashant for PuneriPages.in

We embark on a deep exploration of the US$300 million ammonia and urea plant at Wales, Guyana, analysing the invitation for proposals, project context, investment structure, strategic implications and future prospects. This article provides a full overview aimed at sophisticated readers, investors and industry-observers interested in large-scale fertiliser infrastructure in the Caribbean.

Table of Contents

Project Announcement and Overview

The government of Guyana has officially issued an invitation for proposals (IFP) for a major fertiliser complex: a US$300 million ammonia and urea production facility proposed at Wales, located on the West Bank Demerara. According to the Georgian government’s press release, the ambition is to build a facility capable of producing both ammonia and urea, to advance the country’s agricultural and export potential.

This project represents a strategic pivot for Guyana: moving beyond oil and gas, harnessing chemical-fertiliser manufacturing, and leveraging available natural resources, logistics and regional demand. The plant is expected to feature the latest technology for synthesis of ammonia from feedstocks (possibly natural gas) and subsequent conversion into urea granules for domestic use and export.

Strategic Importance for Guyana’s Economy

Industrial Diversification

Guyana has experienced significant growth in its oil and gas sector, but the government is emphasising downstream industrialisation. The ammonia/urea plant at Wales signals a drive to diversify into fertiliser manufacturing, thereby capturing higher value from minerals or hydrocarbon resources and reducing reliance on raw exports.

Agricultural Supply Chain Enhancement

By producing urea domestically, Guyana aims to bolster its own agricultural sector—ensuring stable supply of fertiliser to farmers, reducing import dependency and supporting food-security goals. This fosters value creation within the country and may yield positive multiplier effects in rural regions.

Export Potential & Regional Positioning

Ammonia and urea are globally traded commodities with strong demand in Latin America and the Caribbean. The proposed plant could position Guyana as a regional hub for fertiliser supply. Shipping from the Demerara river and access to the Atlantic gives logistical advantage. Investors may view this as a compelling entry into Caribbean/Latin fertiliser markets.

Key Project Features & Investment Profile

Financial Scale & Funding

The estimated project cost is US$300 million. This level of capital requires considerable funding mechanisms—whether through equity, debt, government incentives, or public-private partnerships. The invitation for proposals is designed to attract major global fertiliser or chemical firms, and potentially strategic investors with relevant technology and feedstock access.

Location: Wales, West Bank Demerara

The site at Wales offers logistical and infrastructural benefits. Proximity to major river transport, access to utilities, and a labour base are assets. The government’s announcement emphasises readiness to engage serious bidders and ensure infrastructure support.

Feedstock, Technology & Plant Design Considerations

Although full technical details have not been disclosed publicly, typical ammonia/urea plants rely on natural gas or other feedstocks (e.g., coal, hydrogen) to produce ammonia via the Haber-Bosch process, followed by urea synthesis. Bidders will likely be required to outline feedstock sourcing, environmental compliance (emissions, effluent), power supply, and offtake arrangements (for local and export markets).

Employment, Local Content & Social Impact

Large-scale industrial facilities such as this one generate employment—both during construction and ongoing operations—and bring in ancillary industries (logistics, packaging, maintenance). The government will likely include local content clauses, training programmes, and community impact assessments as part of the bidding terms.

Invitation for Proposals: What Firms Should Know

Any firm interested in responding to the IFP for the Wales fertiliser plant must anticipate several critical criteria:

- Technical capability: Demonstrable track record in ammonia/urea plant design, EPC delivery, and commissioning.

- Feedstock access & supply chain certainty: Whether through natural gas rights, long-term contracts, or alternative hydrogen routes.

- Financial strength: Ability to raise or mobilise US$300 million level capital and manage project implementation risk in Guyana.

- Offtake / market strategy: Local offtake within Guyana’s agriculture as well as export logistics, shipping routes via the Atlantic, and trade compliance.

- Environmental & regulatory compliance: Local permitting, emissions management, social licence to operate, and alignment with sustainability expectations.

- Local partner engagement & national benefit: Aligning with Guyana’s industrial policy, local employment, capacity building and region-wide economic benefits.

Successful bidders will be those who integrate the industrial, financial, logistical and social aspects into a compelling value proposition to the Guyanese government.

Implications for Investors and Regional Markets

For Investors

Investors in global fertiliser markets should view the Guyana initiative as a potential new entrant into the Caribbean/Latin supply chain for ammonia and urea. This could influence global pricing, regional trade flows, and provide first-mover advantages. Equity, debt or infrastructure investment funds may find opportunity in such industrial development projects.

For Regional Fertiliser Supply Chains

A dedicated ammonia/urea facility in Guyana could shift regional import flows—countries in the Caribbean and northern South America might obtain nearer-source supply, reducing shipping costs and improving delivery reliability. This could pressure existing suppliers and alter regional trade dynamics.

For Guyana’s Economy

Domestic fertiliser production increases self-sufficiency, supports agricultural output growth, and contributes to job creation and industrial cluster formation. Over the long term, this facility may anchor additional chemical manufacturing, logistics hubs, and export corridors.

Challenges and Risks to Monitor

Feedstock & Energy Supply Risk

Ammonia plants are feedstock-intensive (e.g., natural gas) and energy-intensive (power/steam). Ensuring reliable, affordable feedstock and power is essential. Guyana must provide assurances on gas availability or alternative hydrogen pathways, in order to attract strong bidders.

Commodity Price Volatility

Global prices for ammonia and urea fluctuate based on gas prices, demand cycles, and macroeconomic conditions. Project viability must account for these volatilities and may require offtake contracts or hedging strategies.

Implementation & Construction Risk

Large chemical plants carry execution risk: cost overruns, schedule delays, technical difficulties, regulatory hurdles. Investors will scrutinise the EPC credentials of bidders and the local regulatory framework in Guyana.

Market Demand & Offtake Risk

While regional demand is promising, success depends on securing long-term offtake contracts, competitive pricing against global producers, and logistics efficiencies. Without committed buyers, the plant might face utilisation challenges.

Regulatory, Environmental & Social Approval

Obtaining environmental permits, community support, and moving through procurement processes in a timely manner are essential for success. Any delays may impact investment returns and project timelines.

Why This Project Matters and What We Expect

The US$300 million ammonia and urea plant at Wales stands out as a landmark development for Guyana’s industrial evolution. We expect the following outcomes:

- A pre-qualification phase leading to shortlisted bidders within six to nine months.

- A negotiated EPC contract award by late-2026 or early-2027, subject to permit and financing closure.

- Construction span of 24–30 months, with commissioning possibly by 2029.

- A ripple effect of additional investment in logistics, storage, export terminals and supply chain infrastructure in Guyana.

- Enhanced regional fertiliser supply, potentially reducing Caribbean import costs and generating new trade flows.

For proactive investors and industry watchers, tracking the tender documents, government incentives (tax holidays, export incentives), feedstock and power commitments, and offtake arrangements will provide early signals on project scale, partners and competitiveness.

Conclusion

We believe the Guyana government’s decision to invite proposals for a US$300 million ammonia and urea plant at Wales underscores a strategic leap toward industrialisation, agriculture value-chain enhancement and regional export positioning. While the project offers substantial upside potential, success hinges on strong feedstock access, credible bidders, offtake contracts and execution discipline. For investors, supply-chain participants and regional market players, this initiative demands attention as it may reshape Caribbean fertiliser flows and mid-scale industrial infrastructure investments.